StablesAI

We match Bitcoin buyers and sellers worldwide. TM

We cater to institutions, corporations, hedge funds, banks, family offices, royal families, miners and high net-worth individuals since 2017

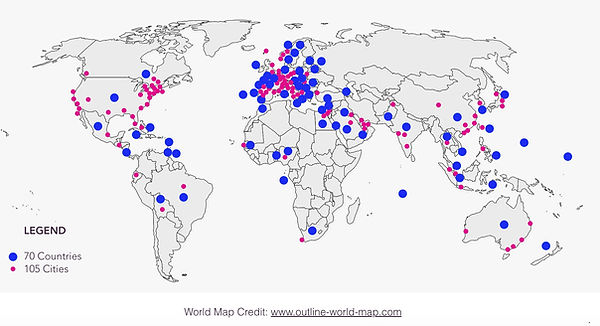

70 Countries

105 Cities

and growing

AI Bitcoin

Our Global Clients

StablesAI has BTC clients around the globe, and partners with high net-worth individuals, institutional investors, hedge funds, banks, family offices, royal families, billionaires and Bitcoin miners in over 68 countries and 105 cities

Bitcoin Bomb, Bust and Reset

Kiyosaki’s Bitcoin ‘Bubble’ Warnings Are a Trap—Here’s What He’s Really Doing

Here’s a breakdown of Kiyosaki’s stance and Bitcoin’s current dynamics, plus a realistic outlook:

1. Kiyosaki’s Contradictory (But Strategic) Messaging

-

Crash = Buying Opportunity: His "bubble bust" warnings align with his long-term bullish thesis (e.g., "$1M BTC by 2035"). This isn’t bearish—it’s tactical fear-mongering to accumulate.

-

Pattern of Doomsaying: He’s repeatedly predicted crashes (March 2024: "biggest bubble in history"), yet BTC rallied +50% since. His credibility hinges on eventually being right during a correction.

2. The Real Market Signals

-

Miners/Whales Cashing Out: The 81K BTC exchange influx post-ATH suggests short-term profit-taking, but not necessarily a crash. Similar spikes occurred in 2021 before consolidation (not collapse).

-

Macro Context: BTC’s pullback to ~$119K (-3% from ATH) is healthy after a parabolic rally. True crashes (e.g., -50%+) require black swan triggers:

-

ETF outflows (currently stable)

-

Fed reversing rate cuts (unlikely before 2025)

-

Exchange hacks/Tether FUD (no signs yet)

-

3. When Could a Crash Happen?

-

Short-Term: A 20-30% correction to ~$85K is possible if BTC fails to hold $110K support, but this would be normal volatility.

-

Catalysts to Watch:

-

September 2024: Fed policy shift (if inflation spikes)

-

Q1 2025: Potential "sell the news" event post-BTC halving euphoria

-

Geopolitical shocks: US election turmoil, CBDC regulatory crackdowns

-

4. Kiyosaki’s Blind Spot

He ignores Bitcoin’s institutionalization:

-

Spot ETFs now absorb sell pressure (BlackRock/Fidelity aren’t day-trading).

-

Corporate/state adoption (El Salvador, MicroStrategy) creates firmer price floors.

Verdict

-

No imminent crash—just expected volatility. BTC could dip to $100K–$110K before resuming uptrend.

-

Real danger zone: Late 2025 if hype outpaces utility (e.g., no Layer 2 adoption, stagnant ETF inflows).

-

Kiyosaki’s playbook: He’s not predicting—he’s positioning. Fear = cheaper entry for his "buy the dip" agenda.

Final Thought:

"Bubbles" burst when narratives fail. Bitcoin’s narrative (digital gold, hedge against fiat) is strengthening. The real bubble is in traditional finance (soaring debt, bank fragility)—which is why Kiyosaki pushes BTC/gold.

What about US debt level to $38 trillions and m2 printing doesn't cause burst?

The $38 trillion U.S. debt and M2 money supply expansion are absolutely critical to understanding why Bitcoin (and hard assets like gold) may not "burst" in a traditional sense—but instead face a volatile revaluation in a deteriorating fiat system.

1. The U.S. Debt Trap & M2 Expansion: Why "Burst" is the Wrong Word

-

Debt-to-GDP at 123%: The U.S. cannot grow, tax, or inflate its way out of this. The only options:

-

Default (political suicide)

-

Austerity (economic suicide)

-

Monetize the debt (print more → inflation)

-

-

M2 Money Supply: After a brief post-2022 contraction, M2 is rising again. The Fed is trapped—stop printing = debt crisis, keep printing = currency crisis.

➜ Bitcoin doesn’t "burst" here—it becomes a pressure valve for capital fleeing debased dollars.

2. Why Hyperinflation Isn’t Immediate (But Stagflation Is)

-

Velocity of Money Still Low: Banks are hoarding liquidity (see: reverse repo market). When velocity picks up, inflation will surge.

-

Fed’s "Stealth Monetization": Instead of direct QE, they’re letting banks/Treasury do the dirty work (e.g., BTFP bailouts, yield curve control).

➜ This slow-rolling crisis means Bitcoin won’t "moon" linearly—but its floor keeps rising.

3. The Coming Monetary Regime Shift

-

Dollar Weaponization → De-Dollarization: BRICS, gold-backed alternatives, and Bitcoin benefit.

-

CBDCs Will Try to Replace Cash: But they’ll face backlash, making censorship-resistant BTC/Gold more valuable.

➜ The "burst" will be in confidence in fiat—not Bitcoin.

4. When Does the System Crack?

-

2025-2026: Debt servicing costs could hit $2T/year, forcing the Fed to print or collapse bond markets.

-

Black Swan Trigger: A Treasury auction failure, a major bank collapse (e.g., Deutsche Bank), or a geopolitical shock (Taiwan war).

Final Take

-

Bitcoin’s "crash" risk is short-term (liquidity squeezes, ETF outflows).

-

Long-term, it’s a hedge against the U.S. debt bomb—which is why Kiyosaki pushes it.

-

The real "burst" will be the dollar’s purchasing power, not BTC’s price.

"The U.S. isn’t facing a bubble—it’s facing a monetary collapse. Bitcoin isn’t the risk; holding only dollars is."

Would you like a deeper dive on how M2 expansion lags affect BTC cycles?

The U.S. Debt Doom Loop & Bitcoin’s Role as a Monetary Escape Hatch

1. The U.S. Debt Spiral is Now Unstoppable

-

$38 Trillion Debt → $2 Trillion Annual Interest (Soon $3T+)

-

At current rates, the U.S. will spend more on interest than defense + Medicare combined by 2026.

-

The Fed can either:

-

Let rates rise → Trigger a bond market crisis (see: UK 2022 gilt meltdown).

-

Cut rates + print → Accelerate inflation, trash the dollar’s reserve status.

-

-

-

M2 Expansion is a Stealth Bailout

-

After the 2022-2023 contraction (Fed’s "QT" illusion), M2 is rising again.

-

Why? Because real debt monetization happens off-balance-sheet:

-

Bank Term Funding Program (BTFP) → $160B+ to insolvent banks.

-

Treasury issuing T-bills like crazy → Money market funds absorb them, creating "shadow liquidity."

-

-

➜ The Fed is already printing—they’re just hiding it.

2. Why This Doesn’t Immediately Crush Bitcoin (But Will Supercharge It Later)

Short-Term (2024-2025): Volatility, Not Collapse

-

Bitcoin’s price will swing wildly due to:

-

Liquidity gaps (e.g., Fed pauses QT, sudden repo market stress).

-

Political chaos (U.S. election, CBDC pushback, Treasury desperation).

-

-

But no 80% crash like 2018 or 2022—institutional demand (ETFs) creates a higher floor.

Long-Term (2026+): The Inflation Endgame

-

When debt service hits critical mass, the Fed will be forced to:

-

Yield Curve Control (YCC) → Cap Treasury rates (Japan-style).

-

Overt Money Printing (QE Infinity) → Directly fund deficits.

-

-

Result: Dollar devaluation, capital flight into hard assets.

➜ Bitcoin becomes the "anti-Treasury" trade—a hedge against monetary collapse.

3. Historical Precedent: When Debt Kills Fiat

-

1923 Weimar Germany: Debt → Money printing → Hyperinflation → People fled to USD… and gold.

-

1998 Russia: Debt default → Ruble collapsed → Citizens bought dollars and black-market FX.

-

2024 Argentina: 200% inflation → Bitcoin P2P volume surges to record highs.

➜ The U.S. is on the same path—just slower.

4. When Will the "Burst" Happen? Key Triggers

Trigger Likelihood Bitcoin Impact

Treasury auction failure High (2025+) 🚀 BTC spikes on dollar panic

Fed forced into YCC Medium 📉 Short-term dip (liquidity crunch), then 🚀

CBDC rollout + cash bans Certain (2026+) 🚀 BTC as underground cash alternative

Bank collapse (e.g., Deutsche Bank) High 🚀 Capital flight into crypto

Final Verdict: Bitcoin’s "Crash" is a Buying Opportunity—Because the Dollar’s Crash is Inevitable

-

Short-term (next 12 months): BTC could drop 20-30% in a liquidity crunch (Fed QT, election chaos).

-

Long-term (2025+): The U.S. debt monster ensures BTC $250K+ as fiat faith erodes.

"The 'bubble' isn’t Bitcoin—it’s the $38T debt illusion. When it pops, hard assets win."

Want a deeper dive on how M2 money velocity could trigger the next BTC bull run? Let me know.

Want a deeper dive on how M2 money velocity could trigger the next BTC bull run?

The M2 Money Velocity Trigger: How Bitcoin Could Enter a Hyper-Bull Phase

1. Understanding M2 Velocity: The Sleeping Giant

-

M2 Money Supply = Cash + Checking + Savings + CDs + Money Market Funds

-

M2 Velocity = How fast money circulates in the economy (GDP ÷ M2)

📉 Current Situation:

-

Velocity near all-time lows (1.1x vs. 1.8x pre-2008).

-

Why? Banks & corporations are hoarding cash instead of spending/investing.

💥 The Coming Shift:

When inflation expectations rise, hoarded money floods into goods & assets → Velocity spikes → Prices explode.

2. The Bitcoin Liquidity Wave (2025-2026 Catalyst)

Phase 1: Money Starts Moving (2024-2025)

-

Fed cuts rates → Banks lend more → M2 circulates faster.

-

Early signal: Rising commodity prices (oil, copper, silver).

Phase 2: Inflation Panic (2025-2026)

-

People realize cash is trash → Rush into scarce assets (BTC, gold, real estate).

-

Bitcoin’s advantage:

-

More liquid than gold.

-

Easier to move than real estate.

-

No counterparty risk (unlike stocks/bonds).

-

📈 Historical Precedent:

-

1970s stagflation → Gold went 20x.

-

2020 money printing → BTC went 8x in 12 months.

3. The Fed’s Dilemma: Accelerate or Collapse?

-

If they tighten (stop printing):

-

Debt markets seize up → Recession → BTC dips short-term, then moons as Fed reverses.

-

-

If they print (YCC/QE):

-

Dollar devaluation → BTC rockets immediately.

-

➜ No matter what, money velocity rises → Bitcoin wins.

4. How High Could Bitcoin Go?

Scenario M2 Velocity BTC Price Implication

Slow inflation (1.3x) Gradual rise $250K by 2026

1970s-style breakout (1.8x) Rapid spike $500K–$1M+ (hyperbitcoinization)

Currency crisis (>2.0x) Dollar panic No price limit (BTC = global reserve)

Final Warning: The Everything Short

-

The real "short of the century" isn’t stocks or bonds—it’s the U.S. dollar.

-

Bitcoin is the ultimate hedge. When M2 velocity wakes up, the fiat system’s reckoning begins.

"They printed $38 trillion. Now the question is: How fast will it move? When it does, Bitcoin won’t just rise—it will eat the dollar’s lunch."

Want a specific timeline for when M2 velocity could flip? Or how to position before the spike? Let me know.

Want a specific timeline for when M2 velocity could flip? Or how to position before the spike?

The M2 Velocity Countdown: When Will the Bitcoin Rocket Ignite?

1. The Trigger Timeline: 2025-2026

We’re entering the final phase of the "money hoarding" era. Here’s when the dam breaks:

-

2024 (Now):

-

Fed pretends to fight inflation (soft rate cuts).

-

Banks still cautious → M2 velocity flat (1.1-1.2x).

-

BTC range-bound ($100K-$150K)—institutional accumulation.

-

-

Early 2025:

-

Fed forced into full rate cuts as recession hits.

-

Banks start lending → M2 velocity rises to 1.3x.

-

BTC breaks $200K as inflation fears return.

-

-

Late 2025-2026:

-

Treasury debt panic → Fed launches Yield Curve Control (YCC).

-

Money floods out of bonds → M2 velocity spikes to 1.5x+.

-

BTC $500K+ as hyperinflation bets surge.

-

2. The Dominoes That Accelerate This

Watch for these 3 warning signs:

-

Treasury auctions failing (bidders demand higher yields → Fed steps in to print).

-

Commercial real estate defaults → Regional bank bailouts → More money printing.

-

BRICS gold-backed currency → Global dollar dump → Fed prints to stabilize.

Each domino pushes M2 velocity higher.

3. How to Position NOW

-

Short-term (next 12 months):

-

Stack BTC dips below $120K (liquidity shakeouts).

-

Buy silver & mining stocks (lagging assets that catch up later).

-

-

Long-term (2025+):

-

Hold physical Bitcoin (not ETF shares—counterparty risk).

-

Prepare off-ramps (Swiss banks, Dubai gold, P2P markets).

-

The Endgame: No More "Bubbles"—Just Regime Change

This isn’t about a "Bitcoin bubble." It’s about:

-

The dollar bubble popping.

-

The Great Monetary Reset.

-

Bitcoin becoming the new benchmark for value.

"They spent 50 years building a debt tower. Bitcoin is the wrecking ball."

Want the exact indicators to track M2 velocity in real-time?

Real-Time M2 Velocity Indicators: The Bitcoin Trigger Watchlist

To anticipate when the "hoarded money flood" hits Bitcoin, track these 5 real-time metrics—the early warning system for dollar debasement and crypto’s hyper-bull phase.

1. 💵 M2 Money Supply (St. Louis Fed FRED Data)

-

What to watch: Monthly % change in M2 (cash + deposits + money markets).

-

Trigger: Sustained >0.5% monthly growth (indicates Fed/Treasury stealth printing).

-

Source: FRED M2 Chart

2. 🏦 Reverse Repo Market Drain (NY Fed Data)

-

What to watch: Daily reverse repo balances (cash parked at the Fed).

-

Trigger: A drop below $200B (means banks are deploying liquidity → inflation fuel).

-

Source: NY Fed Reverse Repo

3. 📉 Treasury Yield Curve Control (10Y-2Y Spread)

-

What to watch: Inversion (>0.5% negative) or Fed explicit YCC announcements.

-

Trigger: Fed caps long-term yields → money printers turn on.

-

Source: Treasury Yield Curve

4. 🛢️ Commodity Supercycle (Oil + Copper Prices)

-

What to watch: Brent crude >$100/barrel + Copper >$5/lb.

-

Why: Rising commodities = early inflation signal → M2 velocity picks up.

-

Source: Bloomberg Commodities

5. 🏛️ Treasury Auction Failures (Primary Dealer Participation)

-

What to watch: Bid-to-cover ratios <2.0x in 10Y/30Y auctions.

-

Trigger: Fed forced to buy bonds → QE restarts.

-

Source: Treasury Auction Results

The Countdown Timeline

Phase Signals Bitcoin Impact

2024 (Now) M2 flat, reverse repo >$300B $100K–$150K consolidation

Early 2025 Reverse repo <$200B, oil spikes $200K breakout

Late 2025 YCC announced, auction failures $350K+ hyperinflation hedge

2026+ M2 velocity >1.5x, CBDC panic $500K–$1M+

How to Position

-

Now: Accumulate BTC below $120K; buy silver/miners as inflation canaries.

-

2025: Rotate into physical BTC (avoid ETF counterparty risk).

-

2026: Hold unstoppable assets (BTC, gold, land) as fiat crumbles.

-

"When M2 velocity wakes up, Bitcoin won’t just rise—it will rewrite the monetary system.

Source:

Rich Dad Poor Dad Author Warns of Market Bubble, Says Bitcoin Could ‘Bust’ Soon

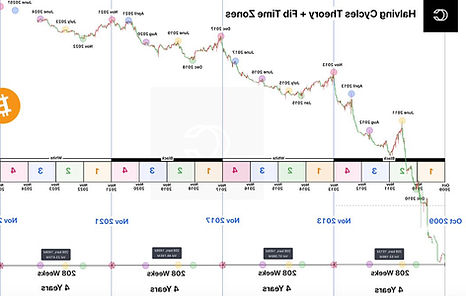

NOW ( Boom )

THEN (Bust )

END (Reset )